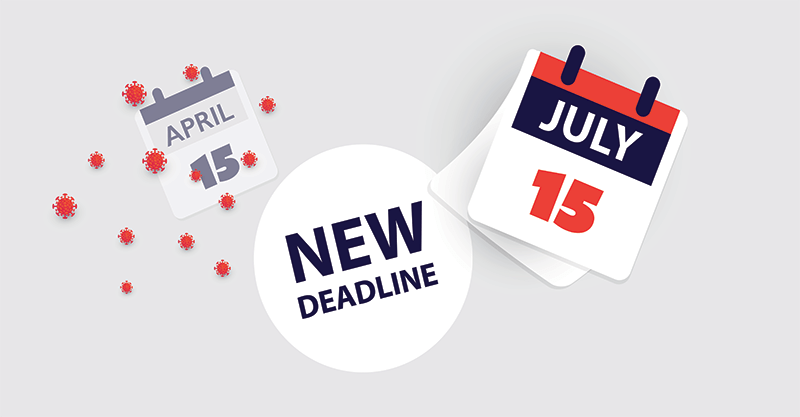

Comptroller Extends Maryland Income Tax Filing Deadline

Comptroller Peter Franchot announced that he is extending the state income tax filing deadline by three months to July 15, 2021. No interest or penalties will be assessed if returns are filed and taxes owed are paid by the new deadline.

This applies to individual, pass-through, fiduciary and corporate income tax returns, including first and second quarter estimated payments and is due to recent and pending legislation at the state and federal levels that impact 2020 tax filings and provide economic relief for taxpayers affected by the COVID-19 pandemic.

The Comptroller’s office will notify the public about the availability of revised and new tax forms on its website and social media accounts. Additional information on tax forms and updates can be found here.

To read more details about the extension and its implications, please read more from the Comptroller’s office here.

As of now, the Internal Revenue Service has kept its filing and payment deadline at April 15. WCS will keep you up to date on any and all changes.

As always, please do not hesitate to call our offices for additional information and to speak to your representative about how this could affect your situation.