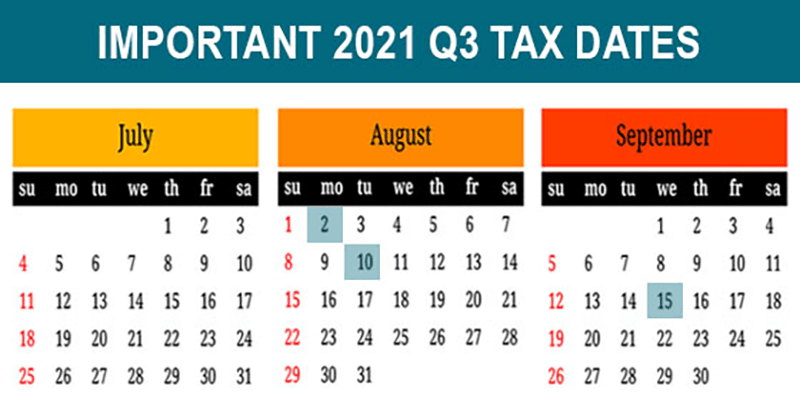

2021 Q3 Tax Calendar: Key Deadlines

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Monday, August 2

- Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941) and pay any tax due.

- Employers file a 2020 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension.

Tuesday, August 10

- Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941), if you deposited all associated taxes that were due in full and on time.

Wednesday, September 15

- Individuals pay the third installment of 2021 estimated taxes, if not paying income tax through withholding (Form 1040-ES).

- If a calendar-year corporation, pay the third installment of 2021 estimated income taxes.

- If a calendar-year S corporation or partnership that filed an automatic extension:

- File a 2020 income tax return (Form 1120S, Form 1065 or Form 1065-B) and pay any tax, interest and penalties due.

- Make contributions for 2020 to certain employer-sponsored retirement plans.

© 2021