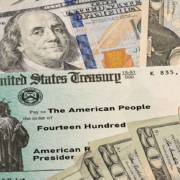

Governor Larry Hogan recently proposed an emergency legislative package that will provide more than $1 billion in direct stimulus and tax relief for Maryland families, small businesses, and those who have lost their jobs as a result of the COVID-19 pandemic. If signed into law as drafted the legislation would

- Repeal all state and local income taxes on unemployment benefits

- Support small businesses with sales tax credits of up to $3,000 per month for four months— for a total of up to $12,000

- Extend unemployment tax relief for small businesses. This provision codifies an emergency order the governor issued last month.

- Safeguards Maryland businesses against any tax increase triggered by the use of state loan or grant funds.

- For families that filed for the states earned income tax credit, provides payments for low-to-moderate income Marylanders, with benefits of up to $750 for families and $450 for individuals. This relief begins with immediate payments of $500 for families and $300 for individuals who filed for the Earned Income Tax Credit (EITC), followed by a second-round stimulus for EITC filers that would provide an additional $250 for eligible families and $150 for individuals. Similar to federal stimulus payments, no application for relief is necessary.

The Governor’s full announcement can be viewed

here.

Employee Retention Credit changed for 2020 & 2021

As part of the recently passed 2021 Consolidated Appropriations Act Congress made a retroactive amendment and extension of the Employee Retention Credit (ERC) which was originally created and made available to businesses as part of the CARES Act of 2020. The extension applies to qualifying wages paid before July 1, 2021.

Previously, a business that received a PPP loan was not eligible to also claim the ERC. However under the new law, PPP borrowers can also apply for the credit, retroactive for 2020. Wages used to satisfy the PPP forgiveness eligibility cannot be used to claim the ERC. Employers that took PPP loans and had excess qualifying payroll should review their eligibility for any ERC available for 2020.

To be eligible for the ERC an employer must have experienced either : (A) Partial or full suspension of operations arising from a governmental order or (B) A significant decrease in gross receipts . The employer must also have continued to pay their employees during this period. A significant decrease in gross receipts is defined as:

- 2020 year- 2020 Gross receipts were less than 50% of gross receipts for the same quarter in 2019

- 2021 year- 2021 Gross receipts less than 80% of gross receipts for the same quarter in 2019

The credit computation depends on eligible payroll costs, the maximum eligible credit per employee is $5,000 for 2020 and $7,000 per quarter for Q1 & Q2 2021 (max $14,000).

For employers that have already filed and received their PPP loan forgiveness, additional guidance will be forthcoming as to claiming the 2020 ERC. For employers who received a PPP loan and have yet to apply for forgiveness they may want to consider holding their applications until additional guidance is released by the IRS and SBA.

For 2021 ERC, eligible employers will claim the ERC similar to how the 2020 ERC was claimed, that is by Form 941. In anticipation of receiving the ERC, eligible employers can fund qualified wages by: (1) Accessing federal employment taxes, including withheld taxes that are required to be deposited with the IRS, and (2) Requesting an advance of the credit from the IRS for the amount of the credit that is not funded by accessing the federal employment tax deposits, by filing

Form 7200, Advance Payment of Employer Credits Due to COVID-19.

While the IRS has not yet updated their website for the new law, we anticipate updates shortly. Information can be obtained

here.

The above is a summary of the ERC, additional eligibility requirements and exemptions apply. Employers with over 100 employees in 2020 or 500 employees in 2021 have additional restrictions.

Please do not hesitate to call our

offices for additional information and to speak to your representative about how this could affect your situation.