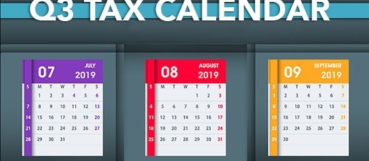

Tax Prep, Planning & Strategy

Targeting and converting your company’s sales prospects

Companies tend to spend considerable time and resources training and upskilling their sales staff on how to handle existing customers. And this…

https://wcscpa.com/wp-content/uploads/2019/06/05_29_19_921297238_bb_560x292.jpg 292 560 wcscpacom /wp-content/uploads/2020/06/1x-logo-no-tagline.png wcscpacom2019-06-25 13:27:532020-10-19 02:46:56Targeting and converting your company’s sales prospects